Wednesday, March 27, 2013

ODFL Still Hanging Fire

Inside day yesterday but up today. ODFL closed up 24 cents at $38.17. Here's where patience comes in. Lets hope ODFL will go up in its little stair stepping way to our target price of about $41. Still underwater in the stock but haven't been stopped out yet. Stay tuned.

Monday, March 25, 2013

Still in the ODFL Business

Considering the weak day on the market ODFL fared pretty well. It managed to close above it's support line and that is good. $38.06 was the closing price. Not a wonderful day but kind of a typical day on the market. Time will tell if ODFL can launch upward from here. Stops remain in at $37.49. Tomorrow is another day! to quote Scarlet O'Hara.

ODFL's Cash Is Still In The Box!

Rough sledding in the market this morning. Nothing unusual there though so get used to it if you want to trade. Bot (trader's short hand for bought) the $40 April calls this morning at the open for 45 cents when the stock opened at $38.56. Looking for a 5% gain would make our target price $40.49. I lowered our stop to below the support line at $37.49 on the close of the day. Of course shortly after getting into ODFL this morning the market started to sell off and the weak sisters holding ODFL followed suit. We however are bold as a lion, "The wicked flee when no man pursueth: but the righteous are bold as a lion." Proverbs 28:1 KJB. So we are sticking to our position at least until closing time if it looks to be closing below $37.49 tonight. The stock sold off a little bit down to $37.50 and has recovered to back above the resistance-now support line for the time being. Reader Cindy asked if I personally trade any of these. The answer is yes! In fact this morning I am trading ODFL. And as is often the case am underwater at the moment. ODFL is a strong stock though hitting new 52 week highs so it is reasonable to expect it to hold its own even on a dipsy doodle day. Stay tuned!

Sunday, March 24, 2013

Will Old Dominion Freight Line Put Cash-In-The-Box?

Old Dominion Freight Line, ODFL, Broke out of its 2 1/2 month long trading range Friday on a very nice volume spike. See the ODFL chart above, courtesy of FreeStockCharts.com. This will make an excellent paper trade. Place a contingent order that if the stock trades above approx. $37.98 then buy the stocks or April $40 Call Option on the open at market. Then we plant to hold it for a 5% gain in the stock price. The protective stop loss should be set just below the resistance-now support line at about $37.69 ish on the close. Friday the the $40 April Calls closed at about 35 cents with a 10 cent spread so the bid price (the price you get if you decide to sell) is about 25 cents right now. However if the stock gains about 5% in the next several days the options could be worth about 82 cents on the bid price according to the option price calculator at OptionsXpress.com so we have a chance of doubling our money on the options if things work out as planned in the next few days. Stay tuned!

Saturday, March 23, 2013

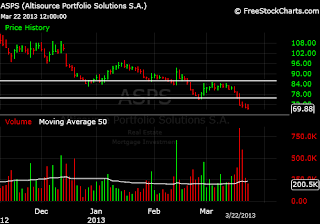

Cashing in on ASPS

ASPS is another Cash-In-The-Box winner. This short side breakout closed tonight (I'm posting this after midnight so the date is Saturday but I'm referring to Friday) at $69.88 after falling as low as $69.46 a mere 11 cents above our target price of $69.35. The April $70 Put is now worth $2.50 and probably triggered a sale when the stock reached $69.46 according to the option calculator, the option hit $3.01 on the bid price today, well above our $2.70 estimated target price. So if we had our order in to sell at our target price of $2.70 the option would have sold for a 13 percent gain. However if we had a contingent order in to sell the option when the stock reached $69.35 we would still be holding our position. If we sold the stock short we would be up $3.12 per share so far on the close. I think I probably would have taken profits on the close today rather than holding over the weekend. So we can call this trade good enough.

I will see if I can find another Cash-In-The-Box for us to paper trade on Monday morning and post it this weekend.

I will see if I can find another Cash-In-The-Box for us to paper trade on Monday morning and post it this weekend.

Wednesday, March 20, 2013

Bitten by ASPS?

Am paper trading ASPS this morning. I have been watching this stock for awhile as a potential breakout short candidate. This might be interesting since it can be hard to "fight the tape" in other words short a stock, or take a bearish position in a bull market which this market is. As you can see from the above chart courtesy of FreeStockCharts.com ASPS broke out of its Cash-In-The-Box on a big volume spike yesterday. So this morning we shorted the stock at the open.for approximately $73.00. We are looking for the stock to move down 5% to $69.35 which is our target price.

If you wanted to play this move using options you would select an April or May Put option at or close to the money which last night was the closing price of ASPS was $71.80 so you would have probably picked the April $70 Put for this morning's opening. Placing the contingency order to buy the Put at market if the stock traded at or below the support line price of $74.75 or less.

This morning's Put would have been purchased at $2.20.There is a horrendous spread on this stock's current month's options of about 90 cents. So right now the Put's bid price is still under water at $1.80 even though the Ask price has moved up to $2.70 already since the stock is already down $1.50 from the open. Remember Puts increase in price if the underlying stock's price falls. If the stock hits its target the option bid price would be about $2.73 according to the option price calculator at OptionsXpress .BTW you can sign up for free at OptionsXpress and use all of their tools, charts and give their Virtual Trading program a try if you've never traded before. This gives you the real hands on experience and is a great way to keep track of your paper trades in simulated reality which is handy even if you have traded before. Virtual Trading is listed under the Toolbox tab at OptionsXpress.

If you wanted to play this move using options you would select an April or May Put option at or close to the money which last night was the closing price of ASPS was $71.80 so you would have probably picked the April $70 Put for this morning's opening. Placing the contingency order to buy the Put at market if the stock traded at or below the support line price of $74.75 or less.

This morning's Put would have been purchased at $2.20.There is a horrendous spread on this stock's current month's options of about 90 cents. So right now the Put's bid price is still under water at $1.80 even though the Ask price has moved up to $2.70 already since the stock is already down $1.50 from the open. Remember Puts increase in price if the underlying stock's price falls. If the stock hits its target the option bid price would be about $2.73 according to the option price calculator at OptionsXpress .BTW you can sign up for free at OptionsXpress and use all of their tools, charts and give their Virtual Trading program a try if you've never traded before. This gives you the real hands on experience and is a great way to keep track of your paper trades in simulated reality which is handy even if you have traded before. Virtual Trading is listed under the Toolbox tab at OptionsXpress.

Monday, March 18, 2013

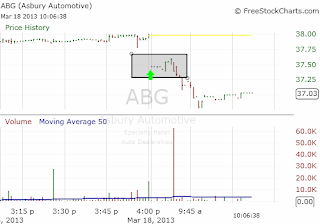

Ins and Outs of ABG

Above is a 1 minute chart of ABG this morning at the open courtesy of FreeStockCharts.com. ABG opened at $37.45. See the arrow in the little rectangle. That's the opening prices at 1 minute intervals. Since the stock opened below the breakout line we bought into the stock at $37.45 on the open and were out of the stock less than a few moments later at the same price or better of $37.55. So about broke even or with a small loss or gain on the stock trade. This makes me realize that the best way to place these orders on open is to place them as a contingency order if XYZ stock sells at or above (below in case of going short) the breakout line price then purchase the stock or option. That way when the stocks are opening lower as they did this morning you don't even get in. Live and learn.

Now if we made this mistake and bought the option this morning we are out a bit more because of the spread between the bid and ask prices of options. When you buy an option you pay the Ask price which is higher than the Bid price which is the price you get when you sell it. On this April $40 Call the difference between bid and ask is 40cents. So in all likelihood you would be out 25 to 40 cents per contract depending on how speedy you were to get out. In this case 5 minutes later gave you a gain in the stock price of about a dime. So this is why we paper trade to find out some of these bugs. However by putting in the contingency orders from now on this will not happen because the buy will not trigger unless the stock is trading higher (or lower in case of going short) than the breakout price line.

Now if we made this mistake and bought the option this morning we are out a bit more because of the spread between the bid and ask prices of options. When you buy an option you pay the Ask price which is higher than the Bid price which is the price you get when you sell it. On this April $40 Call the difference between bid and ask is 40cents. So in all likelihood you would be out 25 to 40 cents per contract depending on how speedy you were to get out. In this case 5 minutes later gave you a gain in the stock price of about a dime. So this is why we paper trade to find out some of these bugs. However by putting in the contingency orders from now on this will not happen because the buy will not trigger unless the stock is trading higher (or lower in case of going short) than the breakout price line.

Sunday, March 17, 2013

Paper Trading ABG

Friday, March 15, 2013

Sleuthing for the Next Cash-In-The-Box

I'm looking for another Cash-In-The-Box opportunity this morning. Look at the chart of ABG courtesy of Worden's FreeStockCharts.com It will be interesting by the end of the day to see whether or not ABG can close above the resistance line I've drawn in at the top of ABG's recent price range. As you can see ABG has been in a range for more than 20 trading days. This makes for an excellent Cash-In-The-Box opportunity IF ABG can break out on heavy volume today that exceeds the 50 day moving average line I have drawn over the volume bars below the price chart. So just what are the parameters definining a Cash-In-The-Box play?

A stock must have been in a price range for 20 trading days or longer. You have to be able to draw a horizontal resistance line touching two or more top prices and a horizontal support line touching two or more of the lowest prices in the range. This is what gives you the rectangle or box that the stock has to break out of. See the lines I drew in above on the ABG chart. Also the stock needs to be above the 50 day moving average of volume. This provides the oh so important volume spike that moves a stock to higher or lower prices depending on its direction. Also the stock should ideally trade at least an average of 100,000 shares per day. Gary B. Smith's formula called for 500,000 or more per day. The stock should be $20 or higher in price. The stock should have closed above the resistance line or below the support line on strong volume above the 50 day moving average of volume.. In fact you can sort for stocks that meet these parameters yourself if you have Worden Charts. Here is the Gary B. Smith formula for scanning for these stocks on Worden 2000 Stock Charts Program:

Gary B. Smith

Worden Sort Formulas for scanning for breakouts

Longs

(C>20) and (AVGV50>500) and (C>MAXC5.1) and (C>C1+1) and (V>1.5*AVGV50)

Shorts

(C>20) and (AVGV50>500) and (C1.5*AVGV50)

Or you can look for candidates yourself for free without any software. Just go to BarChart.com. My favorite lists of stocks to look through are the 52 week highs, 52 week lows, Stocks that Gap Up, Stocks Gap Down, etc.. But almost all of their lists have potential candidates. You will have to see which categories work best for you. This website is a treasure trove of great stock and commodities data. Enjoy browsing. It costs nothing to register and login for an enhanced browsing experience, too.

A phenomena that Gary B. Smith noticed was when the market was ready to turn down then there would be a dearth of setups for longs and more setups for short candidates, and visa versa when the market was bottoming and turning back upward. This tended to keep him from being in the wrong position and getting killed by a sudden market change.

At BarChart.com Once you click on a category a list of stocks moving today will appear. Access each stock's chart by clicking the chart button Link icon to the right. It's pretty easy to check out every stock on the list. After you look at a few charts it gets easier to recognize the telltale flat range a stock has been treading water in to create the Cash-In-A-Box setup. The volume is also graphed at the bottom of each chart so you can see if the volume is spiking up and if the stock trades enough shares per day. If volume is not turned on it's a simple matter to switch it on using the Display volume setting control underneath the chart.

Next you really want to check out your stock. Go to FreeStockCharts.com and you can draw in the support and resistance lines to be sure the prices are breaking above/below resistance/support and you can also check the 50 day moving average for the volume.The horizontal line tool is in the list to the left side of the chart graph. Can you connect two or more of the highest price tops in the range? Can you connect two or more of the lowest prices at the bottom of the range? Is volume spiking above the 50 day moving average line today? Does this stock trade more than 100,000 shares per day on average? Is the stock's price above $20. Did the stock close today above/below the resistance/support lines for the first time since being in the range? If yes then it's a candidate. Buy the stock or the options at the open at market price on the next trading day and watch it go up (or down if it's a short)!

If I find a Cash-In-The-Box pick for another paper trade Monday I will post it this evening or over the weekend.

A stock must have been in a price range for 20 trading days or longer. You have to be able to draw a horizontal resistance line touching two or more top prices and a horizontal support line touching two or more of the lowest prices in the range. This is what gives you the rectangle or box that the stock has to break out of. See the lines I drew in above on the ABG chart. Also the stock needs to be above the 50 day moving average of volume. This provides the oh so important volume spike that moves a stock to higher or lower prices depending on its direction. Also the stock should ideally trade at least an average of 100,000 shares per day. Gary B. Smith's formula called for 500,000 or more per day. The stock should be $20 or higher in price. The stock should have closed above the resistance line or below the support line on strong volume above the 50 day moving average of volume.. In fact you can sort for stocks that meet these parameters yourself if you have Worden Charts. Here is the Gary B. Smith formula for scanning for these stocks on Worden 2000 Stock Charts Program:

Gary B. Smith

Worden Sort Formulas for scanning for breakouts

Longs

(C>20) and (AVGV50>500) and (C>MAXC5.1) and (C>C1+1) and (V>1.5*AVGV50)

Shorts

(C>20) and (AVGV50>500) and (C

Or you can look for candidates yourself for free without any software. Just go to BarChart.com. My favorite lists of stocks to look through are the 52 week highs, 52 week lows, Stocks that Gap Up, Stocks Gap Down, etc.. But almost all of their lists have potential candidates. You will have to see which categories work best for you. This website is a treasure trove of great stock and commodities data. Enjoy browsing. It costs nothing to register and login for an enhanced browsing experience, too.

A phenomena that Gary B. Smith noticed was when the market was ready to turn down then there would be a dearth of setups for longs and more setups for short candidates, and visa versa when the market was bottoming and turning back upward. This tended to keep him from being in the wrong position and getting killed by a sudden market change.

At BarChart.com Once you click on a category a list of stocks moving today will appear. Access each stock's chart by clicking the chart button Link icon to the right. It's pretty easy to check out every stock on the list. After you look at a few charts it gets easier to recognize the telltale flat range a stock has been treading water in to create the Cash-In-A-Box setup. The volume is also graphed at the bottom of each chart so you can see if the volume is spiking up and if the stock trades enough shares per day. If volume is not turned on it's a simple matter to switch it on using the Display volume setting control underneath the chart.

Next you really want to check out your stock. Go to FreeStockCharts.com and you can draw in the support and resistance lines to be sure the prices are breaking above/below resistance/support and you can also check the 50 day moving average for the volume.The horizontal line tool is in the list to the left side of the chart graph. Can you connect two or more of the highest price tops in the range? Can you connect two or more of the lowest prices at the bottom of the range? Is volume spiking above the 50 day moving average line today? Does this stock trade more than 100,000 shares per day on average? Is the stock's price above $20. Did the stock close today above/below the resistance/support lines for the first time since being in the range? If yes then it's a candidate. Buy the stock or the options at the open at market price on the next trading day and watch it go up (or down if it's a short)!

If I find a Cash-In-The-Box pick for another paper trade Monday I will post it this evening or over the weekend.

Thursday, March 14, 2013

A Review of Financial, Options and Stock Trading Newsletters and Services

Over the last few years I've tried quite a number of Stock and Option picking and Financial type newsletters touted as being just wonderful for your portfolio. I have yet to find even one that gives reliable stocks, options picking advice. I have lost money with every one of the following newsletters/trading services, so be sure to check out the reviews of any newsletter or service before you subscribe at StockGumShoe.com:

Weiss Research (Larry Edelson is terrible at timing the markets, also a Mike something or other that runs Leaps Options service). Anyway I lost money following both these jokers.

Quick Hit Trader by Joe Burns. I took a quick hit alright, right in my trading account!

Boom and Bust by Harry Dent, Lousy options picks lost me a chunk.

Market Authority - Gold and Energy Option Trading by James DiGeorgia and his minion Geoff Gorbacz, very amateurish and inconsistent. They did fine during the trial period but after that was over they went on to recommend 5 losers and held them through earnings announcements. Every one of those tanked. Ended up losing more money than they made for me in the beginning. They cut off their winners and let their losers run, not monitoring any stop losses for us as they'd promised and letting our options expire worthless. Very bad.

Maximum Options by Ken Trester - touts his Z-Trades which are nothing more than put option credit spreads. He's deceptive in his ads claiming full disclosure equals his 100% Z-Trade winners, in fact I just got another of his ads claiming this today and sure enough he didnt include my personal biggest loser of all time, the WTW trade. You can see what happened to the stock on the chart above on Feb 14th the stock had gapped down because of bad earnings overnight causing those of us in this trade to lose the maximum loss. He had at least another trade just like this but I didn't trade that one. Of course full disclosure doesn't include his 500% Z-Trade losers. put option credit spreads can be very dangerous. I found out the hard way with Ken Trester who also had us waiting for our credit spreads to expire worthless through earnings announcements so we could keep the credit we received for taking $450 of risk for only $50 of reward per contract. Problem was they came in with bad earnings and tanked overnight before we could activate our protective stop losses. I sure lost the maximum!

If you receive a tantalizing newsletter/trading service offer check out the reviews before you subscribe at StockGumShoe.com

In my experience the newsletters are good for entertainment value only. Follow their trading advice at your own risk.

Weiss Research (Larry Edelson is terrible at timing the markets, also a Mike something or other that runs Leaps Options service). Anyway I lost money following both these jokers.

Quick Hit Trader by Joe Burns. I took a quick hit alright, right in my trading account!

Boom and Bust by Harry Dent, Lousy options picks lost me a chunk.

Market Authority - Gold and Energy Option Trading by James DiGeorgia and his minion Geoff Gorbacz, very amateurish and inconsistent. They did fine during the trial period but after that was over they went on to recommend 5 losers and held them through earnings announcements. Every one of those tanked. Ended up losing more money than they made for me in the beginning. They cut off their winners and let their losers run, not monitoring any stop losses for us as they'd promised and letting our options expire worthless. Very bad.

Maximum Options by Ken Trester - touts his Z-Trades which are nothing more than put option credit spreads. He's deceptive in his ads claiming full disclosure equals his 100% Z-Trade winners, in fact I just got another of his ads claiming this today and sure enough he didnt include my personal biggest loser of all time, the WTW trade. You can see what happened to the stock on the chart above on Feb 14th the stock had gapped down because of bad earnings overnight causing those of us in this trade to lose the maximum loss. He had at least another trade just like this but I didn't trade that one. Of course full disclosure doesn't include his 500% Z-Trade losers. put option credit spreads can be very dangerous. I found out the hard way with Ken Trester who also had us waiting for our credit spreads to expire worthless through earnings announcements so we could keep the credit we received for taking $450 of risk for only $50 of reward per contract. Problem was they came in with bad earnings and tanked overnight before we could activate our protective stop losses. I sure lost the maximum!

If you receive a tantalizing newsletter/trading service offer check out the reviews before you subscribe at StockGumShoe.com

In my experience the newsletters are good for entertainment value only. Follow their trading advice at your own risk.

Wednesday, March 13, 2013

YAY! ABAX Crosses the Finish Line

Hooray! ABAX delivered right on the money. The stock is trading at $47.47 and the $45 April call option sold for $2.70. That's a gain of $1.10 per option and $110 gain for every option contract (BTW options are traded in contracts of 100 shares each). About a 69% gain on your investment in options in less than 3 days, too! If you bought stock instead you are ahead about $2.25 per share.

Anyway ABAX has been an example of how to finance a full-time RV lifestyle on the road. Last month I invested in a smart phone with internet. Now I don't have to even be around my computer to trade. I can access my broker and charts from just about anywhere as long as I'm not in a dead spot. Very handy.Basically all one had to do to trade this was place your order to buy it. Then place your order for it to sell when the stock reached its 5% gain goal and voila! It sold automatically. A total time investment of probably 5 minutes. The rest of the time you can be doing other things.

Anyway ABAX has been an example of how to finance a full-time RV lifestyle on the road. Last month I invested in a smart phone with internet. Now I don't have to even be around my computer to trade. I can access my broker and charts from just about anywhere as long as I'm not in a dead spot. Very handy.Basically all one had to do to trade this was place your order to buy it. Then place your order for it to sell when the stock reached its 5% gain goal and voila! It sold automatically. A total time investment of probably 5 minutes. The rest of the time you can be doing other things.

ABAXing Up

ABAX is progressing nicely trying this morning to break the $47.00 barrier for a third time which probably will do it as the stock seems to be gaining momentum for yet another run up on its way to our 5% gain goal. The $45 April Call option is also up nicely again this morning to $2.50 on the ask and $2.35 just now on the bid price. So for each option contract you are up $75. Not bad on a $160 investment! Above is a chart this morning of ABAX courtesy of BigCharts.com. If this isn't fun what is?

I just checked ABAX again and now the stock's up above $47.00 so it made it through the dollar barrier. That is always a struggle to get through those even dollar levels. The $45 April Call is up to $2.55 on the bid price and $3.00 on the ask. Another 20 cents and the Call will have doubled in price.

One thing I might mention here is be careful when you are playing options. Don't put all your money down on a trade. You could lose it all. Always keep some in reserve so you can make another couple of plays just in case you hit a losing streak and lose a couple of times. Hopefully the third time will be a success and you will be back in business. No strategy is successful all of the time and according to Gary B. Smith this one is successful 8 out of 10 times. So be ready for the two losers to come along in the normal course of events.

I just checked ABAX again and now the stock's up above $47.00 so it made it through the dollar barrier. That is always a struggle to get through those even dollar levels. The $45 April Call is up to $2.55 on the bid price and $3.00 on the ask. Another 20 cents and the Call will have doubled in price.

One thing I might mention here is be careful when you are playing options. Don't put all your money down on a trade. You could lose it all. Always keep some in reserve so you can make another couple of plays just in case you hit a losing streak and lose a couple of times. Hopefully the third time will be a success and you will be back in business. No strategy is successful all of the time and according to Gary B. Smith this one is successful 8 out of 10 times. So be ready for the two losers to come along in the normal course of events.

Monday, March 11, 2013

How Much Cash Is In The Box?

ABAX was our Cash-In-The-Box play I selected last Friday evening for this morning, March 11th. (See Previous Post regarding Cash-In-The-Box).

This morning the $45 April Call option sold on the open for $1.60. The stock opened at $45.11. We had our gain objective of 5% gain on the stock price and to sell automatically at that point. You can also do a contingency order if you are playing options. Just set your option to sell at market when the stock reaches its 5% goal, and your broker will sell your option.

The goal for the gain on the stock is $2.25 which means our target price is $47.36. At this point the stock has been up to $46.60 or $1.49 per share. Always remember to have a protective stop just beneath the breakout line which is at $44.60 so set your stop loss at $44.55 or something underneath the breakout line. I usually just use a mental stop but you can put a hard stop in with your broker. Things can always go wrong so you will be taken out of the stock or option if the stock hits $44.55 for a small loss. Right now the Call Option is worth $2.30 on the ask and $2.00 on the bid. So the option is up about 40 cents. One contract of Call Options, (100 Shares) is up $40.00. For every $160 investment risked you now are worth about $200. If the stock makes its goal you very possibly will double your money depending on volatility. Now isn't this fun? I think so. Stay tuned for more updates and a new pick once this play is over.

This morning the $45 April Call option sold on the open for $1.60. The stock opened at $45.11. We had our gain objective of 5% gain on the stock price and to sell automatically at that point. You can also do a contingency order if you are playing options. Just set your option to sell at market when the stock reaches its 5% goal, and your broker will sell your option.

The goal for the gain on the stock is $2.25 which means our target price is $47.36. At this point the stock has been up to $46.60 or $1.49 per share. Always remember to have a protective stop just beneath the breakout line which is at $44.60 so set your stop loss at $44.55 or something underneath the breakout line. I usually just use a mental stop but you can put a hard stop in with your broker. Things can always go wrong so you will be taken out of the stock or option if the stock hits $44.55 for a small loss. Right now the Call Option is worth $2.30 on the ask and $2.00 on the bid. So the option is up about 40 cents. One contract of Call Options, (100 Shares) is up $40.00. For every $160 investment risked you now are worth about $200. If the stock makes its goal you very possibly will double your money depending on volatility. Now isn't this fun? I think so. Stay tuned for more updates and a new pick once this play is over.

Skirting the Issue

Promised a while back to publish the photos of my done-it-myself RV skirt that I purchased from EZ-Snap company of Canada. I finally took some pictures this weekend before it snowed. I put this skirt on in the fall of 2011. So far since then I have not had one freeze-up. The prior winter of 2010-11 I had something like 10 days of freeze-ups. Temperatures that winter got down to 26 below. The winter temperatures this year and last have not fallen that far as far as I know. According to Accuweather the low so far this year has been 12 below zero. I think it was similar for last winter. However before putting the skirt on my plumbing would freeze up at about the 11 below zero point. It hasn't done that and we definitely hit below that.this winter and last.

This fall I doubled the original number of snaps I put on because of the tremendous winds that we have here on the open prairie. It is not uncommon for the winds to kick up to 90+ mph. Also this fall I went ahead and fastened the base of the skirt to a PVC pipe system as recommended by EZ-Snap on their website EZ-Snap RV Skirt Web Page. You can see a video of how to construct this simple system there. EZ-Snap RV Skirt Video . I used the 3M adhesive studs since I am mechanically challenged and was afraid of putting holes into my RV. They worked well even in the high winds once I doubled the number of snaps. I think when I placed the first set on I allowed about 11 inches between each snap and that was not enough snaps to hold the skirt on without ripping the snaps off. Just too much stress per snap with 90 mph winds flapping the fabric. So this last fall I placed extra snaps on so that there is about a 5" space between the snaps. Held on much, much better.

The first winter I didn't have the fabric affixed to the little PVC pipe system recommended by EZ-Snap. This last fall I engineered the PVC pipe base. It was very simple to do. I then placed small paving blocks inside each corner to stabilize the PVC pipe foundation. We have had lots of wind as usual but the skirt has stayed down this winter. Last winter I'd just used 4x4's to hold the fabric down and that did not work at all in the high winds. I had the skirt loose and flapping to the point you could see clear under the RV and beyond as the wind tore under the RV. I used the EZ-Snap pipe clamps at the every 4 ft. interval. However the next time I order some replacement snaps I will order another bunch of the pipe clamps to place clamps at the every 2 ft. interval. It just makes the fabric stay around the pipe that much better as I had a couple of places where it began to unroll a bit off the pipe. Not a serious problem but I'd prefer it not do that.

This fall I doubled the original number of snaps I put on because of the tremendous winds that we have here on the open prairie. It is not uncommon for the winds to kick up to 90+ mph. Also this fall I went ahead and fastened the base of the skirt to a PVC pipe system as recommended by EZ-Snap on their website EZ-Snap RV Skirt Web Page. You can see a video of how to construct this simple system there. EZ-Snap RV Skirt Video . I used the 3M adhesive studs since I am mechanically challenged and was afraid of putting holes into my RV. They worked well even in the high winds once I doubled the number of snaps. I think when I placed the first set on I allowed about 11 inches between each snap and that was not enough snaps to hold the skirt on without ripping the snaps off. Just too much stress per snap with 90 mph winds flapping the fabric. So this last fall I placed extra snaps on so that there is about a 5" space between the snaps. Held on much, much better.

The first winter I didn't have the fabric affixed to the little PVC pipe system recommended by EZ-Snap. This last fall I engineered the PVC pipe base. It was very simple to do. I then placed small paving blocks inside each corner to stabilize the PVC pipe foundation. We have had lots of wind as usual but the skirt has stayed down this winter. Last winter I'd just used 4x4's to hold the fabric down and that did not work at all in the high winds. I had the skirt loose and flapping to the point you could see clear under the RV and beyond as the wind tore under the RV. I used the EZ-Snap pipe clamps at the every 4 ft. interval. However the next time I order some replacement snaps I will order another bunch of the pipe clamps to place clamps at the every 2 ft. interval. It just makes the fabric stay around the pipe that much better as I had a couple of places where it began to unroll a bit off the pipe. Not a serious problem but I'd prefer it not do that.

Friday, March 8, 2013

Financing an RV Lifestyle with Cash-In-The-Box

What is Cash In The Box? Probably the most profitable, reliable and geometric stock chart pattern. The easiest geometric pattern to recognize on a stock chart is a rectangle. Whatever trend was in place before the rectangle formed is likely to continue once the stock breaks out of the rectangle. Rectangles are a kind of holding pattern once a stock has run up, or run down, kind of like treading water. A stock gets stuck in a trading range between price support on the bottom line and price resistance on the top line. It represents a base of demand support on the bottom price and selling resistance on the top price and the stock vasilates between the two forming a rectangle, or range. When the stock finally breaks out of the box it represents a lucrative trading opportunity, usually an explosive opportunity. That's why my mentor's, Jon Wirrick, his mentor brother, Steve Wirrick, calls them a Cash-In-The-Box. I highly recommend Steve's book, High Octane Trading if you are interested in trading stocks and options for making serious money. What a great way to finance an RV lifestyle with today's mobile internet and online brokers. And it takes only a small amount to get started if you use options.

A great example of a Cash-In-The-Box from earlier this week: would be the AIRM Chart . AIRM traded in a flat range from Jan. 17th 2013 to Feb. 28th 2013. On March 1st 2013 it broke out on a heavy volume spike. It traded the next morning from $45.64 and continued up to $50.56 before backing off for a breather today. I like to use Gary B. Smith's strategy when trading breakouts. So one would buy at market at the open the morning following the breakout.$45.64 with a 10% goal for the move, of about $4.50 ish. The protective stop would be just below the breakout line at about $44.75. Set your stocks or options to sell once the stock reaches the apx. 10% gain at about $50. The gain was reached yesterday March 7th, 2013, so the sale was triggered for a gain on stock of about $4.36 or better. April $45 call options were about $2.40 and once the stock moved would have sold for about $5 for a gain of about $2.60 per share. So for an investment of $240 in call options you could have made a gain of $260 more than doubling your cash. You can see the beauty of options for leverage on a small investment/risk. Later this evening or weekend I will post my next Cash-In-The-Box breakout to trade Monday, March 11th, 2013. Let's paper trade these over the next few weeks to see how they do. Gary B. Smith said his average with this kind of play was about 80% winners over losers. Check back later to get the next breakout plays for Monday morning. I will be doing my picking probably this evening after the market is closed.

This setup looks likely as Cash-In-The-Box breakout and buy for Monday morning.

ABAX

A great example of a Cash-In-The-Box from earlier this week: would be the AIRM Chart . AIRM traded in a flat range from Jan. 17th 2013 to Feb. 28th 2013. On March 1st 2013 it broke out on a heavy volume spike. It traded the next morning from $45.64 and continued up to $50.56 before backing off for a breather today. I like to use Gary B. Smith's strategy when trading breakouts. So one would buy at market at the open the morning following the breakout.$45.64 with a 10% goal for the move, of about $4.50 ish. The protective stop would be just below the breakout line at about $44.75. Set your stocks or options to sell once the stock reaches the apx. 10% gain at about $50. The gain was reached yesterday March 7th, 2013, so the sale was triggered for a gain on stock of about $4.36 or better. April $45 call options were about $2.40 and once the stock moved would have sold for about $5 for a gain of about $2.60 per share. So for an investment of $240 in call options you could have made a gain of $260 more than doubling your cash. You can see the beauty of options for leverage on a small investment/risk. Later this evening or weekend I will post my next Cash-In-The-Box breakout to trade Monday, March 11th, 2013. Let's paper trade these over the next few weeks to see how they do. Gary B. Smith said his average with this kind of play was about 80% winners over losers. Check back later to get the next breakout plays for Monday morning. I will be doing my picking probably this evening after the market is closed.

This setup looks likely as Cash-In-The-Box breakout and buy for Monday morning.

ABAX

Subscribe to:

Posts (Atom)